Want to minimize student loan debt?

Paying for college can seem daunting, and sometimes student loans seem the only possibility. If you aren’t eligible to fill out a Free Application for Federal Student Aid (FAFSA) or did and don’t qualify for enough money to attend college, don’t despair. The truth is that the use of loans to go to college has been falling for at least a decade. There are still multiple options to make paying for college more manageable. We’ll take them one by one, but to start, let’s just make sure you have explored all your financial aid options.

FAFSA

\

If you are eligible to fill out a FAFSA and haven’t, you should. By doing so, you can see which grants and scholarships from the state and federal government you qualify for. Most colleges also use the FAFSA to determine aid available from the college itself. You may also be offered loans but remember that you don’t have to accept any aid offered. Check out CFNC.org’s FAFSA 101 page for more information about the FAFSA.

NC RDS

One important way to make paying for college more manageable is to take advantage of the substantial savings of going to an in-state institution vs. paying the premium for going out of state. North Carolina public institutions and even some private institutions offer a considerable discount through in-state tuition, which you get if you’re a state resident for tuition purposes. North Carolina’s Residency Determination Service (RDS) walks you through the process to figure out if you meet the criteria to be considered a North Carolina resident. North Carolina private colleges also use RDS to determine student eligibility for state need-based scholarships.

To complete this step, go to NCresidency.org. You will need to sign in using your CFNC username and password. If you don’t have one, you can sign up from the login page. Next, it’s time to fill out an application to see if you qualify. Most students get a determination quickly by answering a few simple questions.

Scholarships

Many students bridge the gap between the cost of going to college and other sources of funds by applying for scholarships. CFNC offers a scholarship portal that lets you sort your options to the ones that most likely meet your needs.

NC Promise

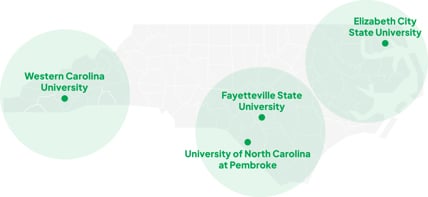

If financial aid and scholarships aren’t enough, what next? Well, whether or not you qualify for in-state tuition, it is worth checking out North Carolina’s NC Promise institutions. These are UNC-System colleges and universities that offer a considerable discount for students.

Elizabeth City State University, Fayetteville State University, The University of North Carolina at Pembroke and Western Carolina University all offer tuition of only $500 a semester for in-state students and $2,500 for out-of-state students.

Transfer from a Community College

A degree from a four-year university or college can be pricy, but you can cut that cost by spending your first two years at one of the state’s 58 community colleges. Fortunately, North Carolina makes it easy for you to transfer to a four-year institution after you have those first four semesters out of the way.

There are two main avenues available to you.

Guaranteed Transfer and Co-Admissions programs: Most UNC-System institutions and many private and independent colleges and universities offer automatic admission for the state’s community college students. These are often programs where you must meet certain academic requirements and complete your two-year degree at a community college.

In some programs, you are even “enrolled” in the four-year institution while still in community college. With that option, you can take advantage of resources on a four-year campus before you arrive. The way these programs work is different depending on the school, so you should ask the admissions office at your community college about them.

The other option is the more traditional transfer process, where you attend a community college and submit an application for transfer to a four-year university when you are ready. You will want to work with your academic advisor to be sure that the credits you are taking are transferable to the institution you wish to go to. To help you, CFNC.org is home to transfer guides that help make your transfer more seamless.

NC Career & College Promise

If you’re still in high school, it may not be too late to get a jump start on your college career. The state’s Career & College Promise program (CCP) allows North Carolina high school students to dual-enroll in high school and classes at their local community college. By doing this, you are able to earn college credit while you are still in high school. Check with your school counselor to see if your school offers CCP and learn about participation requirements.

Exams for Credit

Perhaps you already have enough knowledge to forgo some of your college credits.

Passing Advanced Placement (AP) exams while still in high school can often qualify you for college credit. So, if you’ve taken AP classes and successfully passed the related exam, check with your college of choice to see if you can get course credit at their institution.

In addition, the College-Level Examination Program® (CLEP) offers college exams that can help you earn college credit while saving you money on the full cost of a college course. According to clep.collegeboard.org, you can earn credit at 2,900 universities through these exams.

There is even a path, through Modern States, where you can take free online preparation classes in several courses from high-quality universities that prepare you to take the exam. When finished, you can receive a voucher for the exam fee, so you can take your CLEP exams and get credit at no cost, essentially bypassing some of the courses you would have to pay for at college.

Forgivable Loans

Not all loans mean taking on the lifelong task of paying off student debt. North Carolina established the Forgivable Education Loans for Service program in 2011. It offers forgivable loans for qualified students who are enrolling in certain education programs in high-need jobs in North Carolina. Essentially, you pay off each year of loan through a year of service to the State by working in your field of study. There are many qualifying programs, including in the education and medical professions.

You can learn more about the program at CFNC’s Forgivable Education Loans for Services.

Tax Credit

Another possible way to save money is through a tax credit. An education tax credit helps by reducing the amount of money you owe on your tax return, and if that credit goes far enough, you may even get a tax refund. You can learn more about whether you qualify for this at the IRS website in the section on education credits.

Service Programs and More

Service programs are a good way to give back while paving a way to college. Below are a few possible options.

AmeriCorps is a national service program that describes itself as a federal agency that “brings people together to tackle the country’s most pressing challenges through national service and volunteering. AmeriCorps members and AmeriCorps Seniors volunteers serve with organizations dedicated to the improvement of communities.”

In addition to a living allowance, AmeriCorps offers money that can help pay for college or trade school. Plus, if you’re doing it after graduation, you can get money to repay your student loans.

Learn more about AmeriCorps.

The Reserve Officers’ Training Corps, or ROTC, is another avenue to explore. If you’re interested in military service, ROTC will pay for tuition for college while you are training to become an officer. It is offered by the Army, Navy and Air Force, but not all colleges have the program available.

If you’re a veteran thinking about going to college, you might be able to take advantage of the GI Bill, which helps qualifying veterans and their family members get money for tuition and expenses for college or job training. Learn more about the GI Bill.

If none of those options work for you, there are also the five U.S. Military Academies where the federal government will cover tuition, room and board if you are accepted.

They are:

- The Army’s U.S. Military Academy at West Point

- The U.S. Naval Academy in Annapolis, Maryland

- The U.S. Coast Guard Academy in New London, Connecticut

- The U.S. Merchant Marine Academy in Kingsport, N.Y.

- The U.S. Air Force Academy in Colorado Springs, Colorado

Finally, if you want training but don’t necessarily need to go to college quite yet, Year Up Charlotte could also be a viable option. The program offers job training for 18–29-year-olds that prepares you for an internship with a top corporate employer. Those that complete the program gain valuable work experience that can help them get a job or continue their education. They can also earn credit towards a college degree at partnering community colleges.

From the website: “With tuition-free opportunities, you'll gain hands-on experience and professional development through engaging virtual sessions, followed by job support services through YUPRO Placement.”

Don’t Give Up

Paying for college can feel overwhelming, but most students and families are able to put together a plan that combines family funds, financial aid and other sources like scholarships that help make paying for college more manageable. Some of the options above help you reduce the cost of college up front through avenues like in-state tuition, earning college credit while still in high school or through exams. Others, like forgivable loans, service or training programs, and scholarships can help narrow the funding gap. Looking at all of your options can bring the possibility of going to college within reach.