Tax Benefits

Perhaps the biggest advantage of saving in a 529 program is the tax-free earnings. The money you invest may grow over time and any earnings are free from federal and state income tax when they are withdrawn and used for Qualified Education Expenses (QEE).

Qualified Withdrawals are your key to tax-free earnings

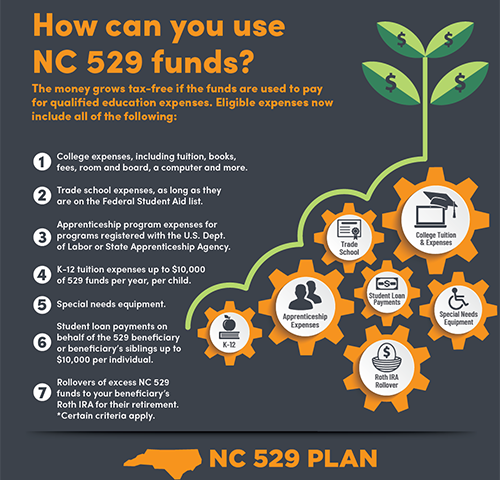

Examples of Qualified Education Expenses (QEE) include:

- College expenses, including tuition, books, fees, room and board, a computer and more

- Trade school expenses, as long as they are on the Federal Student Aid school list

- Apprenticeship program expenses for programs registered with the U.S. Dept. of Labor or State Apprenticeship Agency

- K-12 tuition expenses up to $10,000 of 529 funds per year, per child

- Special-needs equipment

- Student loan payments on behalf of the 529 Beneficiary or Beneficiary's siblings up to $10,000 per individual

- Rollovers of excess NC 529 funds to your beneficiary’s Roth IRA for their retirement. *Certain criteria apply.

Life happens… there are times you may need a Non-Qualified Withdrawal

In the event you elect to take a Non-Qualified Withdrawal, it would be subject to the following terms:

- An automatic 10% federal penalty in addition to state and federal income tax on the earnings. Participants do not have the ability to specify their principal or earnings amounts.

- Non-Qualified Withdrawals can only be made payable to the Participant, so the penalty and taxes are the Participant's obligation upon filing taxes for the respective year.

- The Program charges a $50 processing fee which is deducted from the withdrawal.

- A full balance Non-Qualified Withdrawal will automatically close the Account.

There are a few instances when the 10% federal penalty and the $50 Program processing fee are waived, such as receipt of Scholarship, Attendance at a US Military Academy, and Death or Permanent Disability of the Beneficiary.

What do I need for my taxes?

You should retain documentation to support (i) any expenses that you will claim as Qualified Education Expenses, or (ii) any Withdrawals on account of a Beneficiary’s death, disability, receipt of a Scholarship, or attendance at a U.S. Military Academy. The Program is not responsible for maintaining such documentation, even if such documentation is requested by the Program to administer your withdrawal request. You should consult an attorney or tax advisor as to what documentation may be required. See the Program Description for more information.